lk-kojven.ru Community

Community

Insurance Agency Owners Salary

The average Agency Owner salary in Florida is $, as of July 29, , but the range typically falls between $, and $, Salary ranges can vary. It is very common for Allstate and State Farm agencies to generate profit of % of revenue when you include the owner's salary, benefits and net income. A. The average salary for a Agency Owner is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could earn the. Insurance sales agents earn an average yearly salary of $49, Wages typically start from $30, and go up to $, 9% above national average ○ Updated. In that scenario, an agency owner should pay themselves between $, and $, USD a year. There's technically no limit on how much you can pay yourself—. Farmers Insurance · Average results in year one typically produce revenue in the range of $K-$K and bonuses over the three year program are commonly in the. The average Agency Owner salary in the United States is $ as of July 29, , but the salary range typically falls between $ and $ As an Insurance Agency Owner, I make an average base salary of $ per Year in the US. Finger out salary benefits for Insurance Agency Owner. The average salary for a Agency Owner is $ per year in California. Learn about salaries, benefits, salary satisfaction and where you could earn the. The average Agency Owner salary in Florida is $, as of July 29, , but the range typically falls between $, and $, Salary ranges can vary. It is very common for Allstate and State Farm agencies to generate profit of % of revenue when you include the owner's salary, benefits and net income. A. The average salary for a Agency Owner is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could earn the. Insurance sales agents earn an average yearly salary of $49, Wages typically start from $30, and go up to $, 9% above national average ○ Updated. In that scenario, an agency owner should pay themselves between $, and $, USD a year. There's technically no limit on how much you can pay yourself—. Farmers Insurance · Average results in year one typically produce revenue in the range of $K-$K and bonuses over the three year program are commonly in the. The average Agency Owner salary in the United States is $ as of July 29, , but the salary range typically falls between $ and $ As an Insurance Agency Owner, I make an average base salary of $ per Year in the US. Finger out salary benefits for Insurance Agency Owner. The average salary for a Agency Owner is $ per year in California. Learn about salaries, benefits, salary satisfaction and where you could earn the.

The average Agency Owner salary in Florida is $, as of July 29, , but the range typically falls between $, and $, Salary ranges can vary. As agency owners, we are all aware that as we build income in our business we're also building value. The average salary for Brightway Insurance owners is $83, per year. Brightway Insurance owner salaries range between $49, to $, per year. The average salary for a Agency Owner is $ per year in United States. Learn about salaries, benefits, salary satisfaction and where you could earn the. The average INSURANCE AGENCY OWNER SALARY in the United States as of July is $ an hour or $ per year. Get paid what you're worth! The estimated total pay for a Insurance Agency Owners is $, per year, with an average salary of $70, per year. These numbers represent the median. Actual production and compensation results will vary and depend on the strategy, tactics and efforts of the individual agents. The Auto Club Group cannot. Agency Service Representatives make an average of $ / year in North Carolina, or $ / hr. Try lk-kojven.ru's salary tool and access the data you. Learn more about the Farmers agency owner selection process, plus how you can grow your own business with Farmers Insurance. Insurance agents don't actually earn salaries, because they're independent business owners in charge of their own income. But the longer you're an agent. Average income of a life insurance agent is around $30, So the income range is very wide. Agency Service Representatives make an average of $ / year in USA, or $ / hr. Try lk-kojven.ru's salary tool and access the data you need. Average salaries for Farmers Insurance Group Agency Owner: $ Farmers Insurance Group salary trends based on salaries posted anonymously by Farmers. On average, agencies pay % of agency revenue for new business and % for renewal business. So, if you are a producer (a nifty title insurance salesmen. The top 10% earn $, or greater in gross annual revenue. Based on a majority of Allstate Exclusive Agent's gross income earned during , excluding. The average State Farm Insurance Agency Owner earns $ annually. Explore State Farm Insurance Agency Owner salaries by job location and 1 real State. Are you ready to realize your dream of owning your own business? Take the steps today and learn more about becoming an American Family Insurance agency. The 'flip' answer is always 'as much as you can afford'. But that really doesn't address the issue of fair compensation for agency ownership. When asked the. You can't get people that are not going to pay their bills. It's good for somebody that say, went to college, moves back home, doesn't ever want to move, wife's. Owners Compensation. How should insurance agency owners be paid? Until recently this question was rarely asked. Most agencies paid their owners as much as.

401k Cash Investments

:max_bytes(150000):strip_icc()/401kplan.asp-4103bbcbcf0943068955a6c47d6eca0c.png)

The goal of investing in a (k) plan is to grow your money over time through investments. Because it's an active investment (and not like a savings. Strategies for Investing Your Money · 1. Pre-Arranged Portfolios Read More. Close. Advantages of Pre-Arranged Portfolios · 2. Creating Your Own Portfolio from our. Cash investments include products that have the low risk and accessibility of cash, combined with potentially higher returns than traditional savings accounts. By contrast, (k) plans often permit participants to direct their own investments within certain categories. Under (k) plans, participants bear the risks. Likely even better, for tax purposes, is to participate in an employer-sponsored retirement plan such as a (k), (b), Most investors maintain a “cash”. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available. The "pay yourself first" method works well, which is why your employer's (k) plan is a good place to save cash. Once you get past the endless prose of the. The ability to invest for retirement is a major incentive to use a (k)—investing your money gives it a chance to benefit from compounding returns and a. Schwab One Interest and Bank Sweep are the two primary cash features. The Money Fund Sweep is an additional cash feature available to certain accounts. The goal of investing in a (k) plan is to grow your money over time through investments. Because it's an active investment (and not like a savings. Strategies for Investing Your Money · 1. Pre-Arranged Portfolios Read More. Close. Advantages of Pre-Arranged Portfolios · 2. Creating Your Own Portfolio from our. Cash investments include products that have the low risk and accessibility of cash, combined with potentially higher returns than traditional savings accounts. By contrast, (k) plans often permit participants to direct their own investments within certain categories. Under (k) plans, participants bear the risks. Likely even better, for tax purposes, is to participate in an employer-sponsored retirement plan such as a (k), (b), Most investors maintain a “cash”. Cash and cash equivalents such as certificates of deposit (CDs) or money market funds are among the safest and most liquid of investments. Cash is available. The "pay yourself first" method works well, which is why your employer's (k) plan is a good place to save cash. Once you get past the endless prose of the. The ability to invest for retirement is a major incentive to use a (k)—investing your money gives it a chance to benefit from compounding returns and a. Schwab One Interest and Bank Sweep are the two primary cash features. The Money Fund Sweep is an additional cash feature available to certain accounts.

Choose your investments When your money hits your account, it will be automatically deposited as either cash (in a brokerage account, you might see something. (k) retirement plans · Capital Group, home of American Funds®, offers a variety of (k) plan solutions and investment options to help employers and plan. Leaving the money with your old employer brings risks, including having less control over your savings. Rolling over your old (k) money to a new account may. THE CONTENT ON THIS WEBSITE IS INTENDED FOR INSTITUTIONAL CASH MANAGEMENT INVESTORS ONLY. Dreyfus is a division of Mellon Investments Corporation (MIC), a. 6 low-risk investments for yield seekers · 1. Certificates of deposit (CDs) · 2. Money market funds · 3. Treasury securities · 4. Agency bonds · 5. Bond mutual funds. Cash investments— · Shorter-term CDs and T-bills can be attractive short-term investments if you have a specific timeline and value a certain return. · Longer-. You can start by having as little as $10 deducted from each paycheck, then choose how your money will be invested from a variety of options. With a tax-deferred. In most cases, it would be better to leave your retirement savings fully invested and find another source of cash. On the flip side of what's been discussed so. These funds let you easily access your money when you need it, whether you are saving for the short term or reserving it for a future investment. I'm sitting at 56% invested and 43% cash, which feels like an imbalance. I have ~37k invested in retirement, pretty evenly divided between k and my Roth. We screened retirement funds in six categories — large-cap, mid-cap, small-cap, foreign, bond and target-date — to find the best (k) investments in Consider the Vanguard Cash Plus Account, money market funds, or brokered certificates of deposit (CDs) to save for your short-term goals. At age 60–69, consider a moderate portfolio (60% stock, 35% bonds, 5% cash/cash investments); 70–79, moderately conservative (40% stock, 50% bonds, 10% cash/. Principal is a leading defined contribution (DC) investment manager with flexible retirement plan investment choices to help advisors meet the diverse needs. Cash and cash equivalents can provide liquidity, portfolio stability and emergency funds. · Cash equivalent securities include savings, checking and money market. While not insured by the FDIC, the funds are required by federal regulations to invest in short-maturity, low-risk investments, making them less prone to market. With a (k), you contribute through payroll deductions, meaning the money is taken out of your paycheck automatically. You decide how much of your pay to. In particular, avoid using a (k) debit card, except as a last resort. Money you borrow now will reduce the savings vailable to grow over the years and. Lower-risk investments such as cash, CDs, money market funds, and bonds present far less risk of loss but also lower rates of return. If you overinvest your Money market and stable value funds are fancy words for cash, a low risk, low return investment, and the return from cash usually lags behind inflation. This.

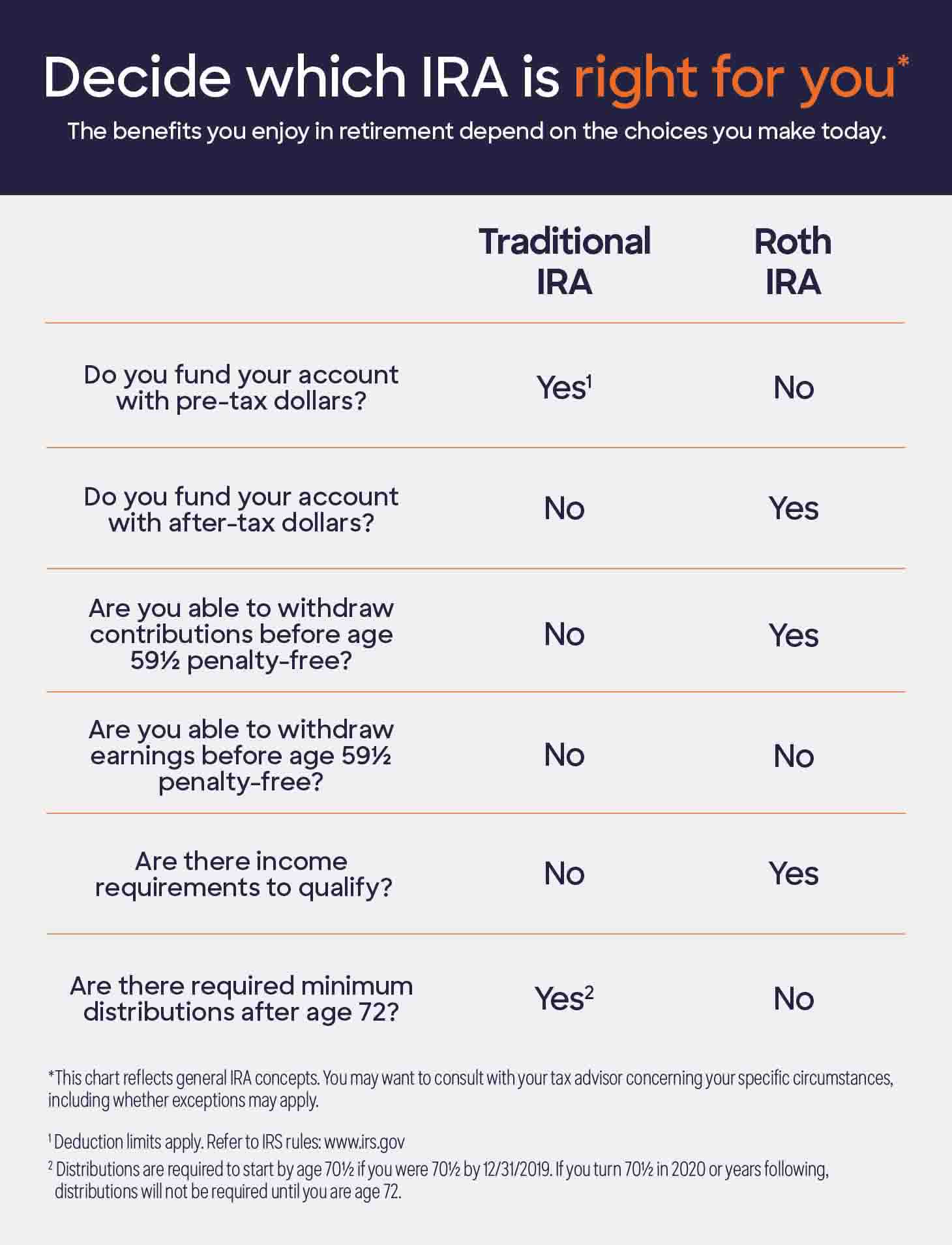

Is Roth Or Traditional Ira Better

A Roth can take more income out of your hands in the short term because you're forced to contribute in after-tax dollars. With a traditional IRA or (k), by. Key Points With a Roth IRA, your contributions are made after tax, but then your money grows tax free. Qualified withdrawals also come out tax free. To be. The IRA that's better for you, a Roth IRA or a traditional IRA, depends on the timing of their tax breaks, eligibility standards, and the access they offer. On the other hand, if you are young and just starting a career, then a Roth could be a better option. The tax savings from the deductions of the traditional IRA. Generally speaking, most people are better off doing traditional for k and Roth for an IRA. This minimizes taxes now while having a mix of assets in. With a Roth IRA, there is no upfront tax advantage, but you'll pay no tax on the earnings on your contributions⁵ when you make qualified withdrawals.⁶ No matter. If you are making less, Roth isn't better because the growth is tax free. That's bad math. The traditional IRA has tax-free contributions and so. A Roth IRA may be better if you expect to be in a higher income tax bracket in retirement. That's because with a Roth, you make contributions with after-tax. With a Roth IRA, your contribution isn't tax-deductible the year you make it, but your money can grow tax-free and your withdrawals are tax-free in retirement. A Roth can take more income out of your hands in the short term because you're forced to contribute in after-tax dollars. With a traditional IRA or (k), by. Key Points With a Roth IRA, your contributions are made after tax, but then your money grows tax free. Qualified withdrawals also come out tax free. To be. The IRA that's better for you, a Roth IRA or a traditional IRA, depends on the timing of their tax breaks, eligibility standards, and the access they offer. On the other hand, if you are young and just starting a career, then a Roth could be a better option. The tax savings from the deductions of the traditional IRA. Generally speaking, most people are better off doing traditional for k and Roth for an IRA. This minimizes taxes now while having a mix of assets in. With a Roth IRA, there is no upfront tax advantage, but you'll pay no tax on the earnings on your contributions⁵ when you make qualified withdrawals.⁶ No matter. If you are making less, Roth isn't better because the growth is tax free. That's bad math. The traditional IRA has tax-free contributions and so. A Roth IRA may be better if you expect to be in a higher income tax bracket in retirement. That's because with a Roth, you make contributions with after-tax. With a Roth IRA, your contribution isn't tax-deductible the year you make it, but your money can grow tax-free and your withdrawals are tax-free in retirement.

A Roth IRA may be beneficial if you expect to fall in a higher tax bracket when you make withdrawals. A traditional IRA may be beneficial if you are seeking tax. 1) A Roth IRA gives you the option of accessing the contributed capital with no penalty while a traditional IRA imposes a penalty for early. When weighing a traditional vs. a Roth IRA, you need to consider which gives you the best tax savings. If you expect your taxes will be lower in retirement due. Is a Roth IRA conversion right for you? Answer a few quick questions and see next steps, depending on your personal situation and financial goals. Despite not offering an upfront tax deduction, a Roth IRA can offer flexibility to manage your taxes and spending in retirement because you can withdraw money. A general guideline is that if you think your tax bracket will be higher when you retire than it is today, you may want to consider a Roth IRA—especially if you. Although using retirement money before retirement is bad for you, if you're in a real bind, the Roth IRA lets you use your contributions (and, in many cases. A Roth IRA differs from a traditional IRA in that it pays off down the road (you may withdraw money tax-free if you have reached age 59½ and it's been at least. The primary difference between traditional and Roth IRAs is how and when your money is taxed. Tax deferred growth. The money contributed to either IRA type. Yes, Roth IRAs have several advantages over traditional IRAs, because of the four factors above. The Roth IRA avoids lifetime RMDs, avoids state estate taxes. If the answer is yes, distributions from a Traditional IRA would be subject to federal but not state income taxes. If that is the case, would you be better off. Is there an age limit? You can contribute to a Roth IRA at any age. As a result of changes made by the SECURE Act, you can make contributions to a. On the other hand, if you meet the income requirements for a Roth IRA and expect to be in a higher tax bracket later in life, paying taxes on your contributions. Traditional IRAs offer tax-deferred growth potential. You pay no taxes on any investment earnings until you withdraw or “distribute” the money from your account. With a Roth IRA, you make contributions with after-tax dollars and you're not eligible for any immediate tax benefits or deductions. With a traditional IRA, you. Generally, you're better off in a traditional if you expect to be in a lower tax bracket when you retire. By deducting your contributions now, you lower your. Conversely, if you are just starting your career and there's a good chance that you will be in a higher tax bracket later in life, a Roth could be a better. Traditional IRA vs. Roth IRA: What you need to know ; Taxes, You make contributions on a pretax basis (if your income is below a certain threshold) and pay no. On the other hand, a Roth IRA offers tax-free withdrawals during retirement, but contributions are made with after-tax dollars. Nevertheless, your decision. Which is better, a Traditional IRA or a Roth IRA? Traditional IRAs offer tax-deferred earnings and tax-deductible contributions. Roth IRAs offer tax-free.

Stock Price Of Ge

Stock analysis for GE Aerospace (GE:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Based on 10 Wall Street analysts offering 12 month price targets for GE Aerospace in the last 3 months. The average price target is $ with a high forecast. GE has a High Technical Rating by Nasdaq Dorsey Wright. Discover why technical analysis matters. $ %. Sep 6, PM ET. Historical Prices for GE Aerospace ; 08/19/24, , , , ; 08/16/24, , , , GE Aerospace (GE) · After Hours PM ET 09/06/ $ %. Previous Close · $ · ; % · Volume: 4 Mil · Volume % Chg: 22% · Get a. Stock price history for General Electric (GE). Highest end of day price: $ USD on Lowest end of day price: $ USD on Stock. GE Aerospace soared to a multiyear high when it broke out on earnings July The stock has gained over 25% since GE Aerospace became a pure aviation company. See today's GE stock price for General Electric Co NYSE: GE stock rating plus other valuable data points like day range, year, stock analyst insights. GE Aerospace · AT CLOSE PM EDT 09/06/24 · USD · % · Volume3,, Stock analysis for GE Aerospace (GE:New York) including stock price, stock chart, company news, key statistics, fundamentals and company profile. Based on 10 Wall Street analysts offering 12 month price targets for GE Aerospace in the last 3 months. The average price target is $ with a high forecast. GE has a High Technical Rating by Nasdaq Dorsey Wright. Discover why technical analysis matters. $ %. Sep 6, PM ET. Historical Prices for GE Aerospace ; 08/19/24, , , , ; 08/16/24, , , , GE Aerospace (GE) · After Hours PM ET 09/06/ $ %. Previous Close · $ · ; % · Volume: 4 Mil · Volume % Chg: 22% · Get a. Stock price history for General Electric (GE). Highest end of day price: $ USD on Lowest end of day price: $ USD on Stock. GE Aerospace soared to a multiyear high when it broke out on earnings July The stock has gained over 25% since GE Aerospace became a pure aviation company. See today's GE stock price for General Electric Co NYSE: GE stock rating plus other valuable data points like day range, year, stock analyst insights. GE Aerospace · AT CLOSE PM EDT 09/06/24 · USD · % · Volume3,,

Get Ge Vernova Inc (GEV:NYSE) real-time stock quotes, news, price and financial information from CNBC. GE Logo, General Electric (GE) Stock Price Today: $ (%) The closing share price for General Electric (GE) stock was $ for Friday. GE Historical Data ; Aug 18, , , , , ; Aug 15, , , , , GE Aerospace historical stock charts and prices, analyst ratings, financials, and today's real-time GE stock price. The current price of GE is USD — it has decreased by −% in the past 24 hours. Watch GE Aerospace stock price performance more closely on the chart. GE Aerospace (lk-kojven.ru): Stock quote, stock chart, quotes, analysis, advice, financials and news for Stock GE Aerospace | Nyse: GE | Nyse. Stock Price Target. High, $ Low, $ Average, $ Current Price, $ GE will report FY earnings on 01/22/ Yearly Estimates. GE Aerospace ; Day Range - ; 52 Wk Range - ; Volume, M ; Market Value, $B ; EPS (TTM), $ View GE Aerospace GE stock quote prices, financial information, real-time forecasts, and company news from CNN. In depth view into GE (GE Aerospace) stock including the latest price, news, dividend history, earnings information and financials. GE Aerospace ; Open. $ Previous Close$ ; YTD Change. %. 12 Month Change. % ; Day Range · 52 Wk Range - Discover real-time GE Aerospace Common Stock (GE) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. GEV | Complete GE Vernova Inc. stock news by MarketWatch. View real-time stock prices and stock quotes for a full financial overview. General Electric | GEStock Price | Live Quote | Historical Chart ; Woodward, , , % ; Xylem, , , %. The all-time high GE Aerospace stock closing price was on August 28, The GE Aerospace week high stock price is , which is % above. Price and Volume ; NaN · · NaN · Discover real-time GE Aerospace Common Stock (GE) stock prices, quotes, historical data, news, and Insights for informed trading and investment decisions. News & Analysis · Here's Why GE Aerospace Stock Slumped Today · What Is the Trillion-Dollar Club? · Investing in Nuclear Energy Stocks in · Better Buy: GE. The GE Aerospace stock price today is What Is the Stock Symbol for GE Aerospace? The stock ticker symbol for GE Aerospace is GE. Is GE the Same as $GE? Get the latest General Electric Co (GE) real-time quote, historical performance, charts, and other financial information to help you make more informed.

Home Improvement Loan Vs Personal Loan

A personal loan is unsecured debt, meaning it is not backed up by collateral. If you default on unsecured debt due to nonpayment, the lender must sue you in. A home improvement loan is a personal loan that you may borrow without securing it against your home. That means if you default at the loan, your home will not. A personal loan for home improvement doesn't require your home or car as collateral, so you won't have to deal with inspections or appraisals. It may be a. A HELOC gives you revolving access to a certain amount of money that you can use as needed over time, making it a flexible financing option for ongoing or. Unsecured loans require a construction bid or documentation of materials to be purchased but do not add a lien to your property. An unsecured loan is great for. A home improvement loan is a type of personal loan taken out specifically for the purpose of renovating or repairing your home. You can use a home. Why borrow for your home? · Renovations. A new kitchen, bathroom or finished basement can be very expensive. With a loan or line of credit, you won't have to. Unsecured personal loans can be a good way to pay for home renovations if you have good credit, lack sufficient equity built in your home or just need to borrow. For months I don't think it makes a big difference. A personal loan is typically a much easier process to go through, so I would probably. A personal loan is unsecured debt, meaning it is not backed up by collateral. If you default on unsecured debt due to nonpayment, the lender must sue you in. A home improvement loan is a personal loan that you may borrow without securing it against your home. That means if you default at the loan, your home will not. A personal loan for home improvement doesn't require your home or car as collateral, so you won't have to deal with inspections or appraisals. It may be a. A HELOC gives you revolving access to a certain amount of money that you can use as needed over time, making it a flexible financing option for ongoing or. Unsecured loans require a construction bid or documentation of materials to be purchased but do not add a lien to your property. An unsecured loan is great for. A home improvement loan is a type of personal loan taken out specifically for the purpose of renovating or repairing your home. You can use a home. Why borrow for your home? · Renovations. A new kitchen, bathroom or finished basement can be very expensive. With a loan or line of credit, you won't have to. Unsecured personal loans can be a good way to pay for home renovations if you have good credit, lack sufficient equity built in your home or just need to borrow. For months I don't think it makes a big difference. A personal loan is typically a much easier process to go through, so I would probably.

A home improvement personal loan is an unsecured (no collateral) fixed-rate personal loan that is used for home renovations and repairs and repaid over a. A home improvement loan is a personal loan used to renovate, remodel, or improve your home. Home improvement loans can be used for minor or major projects. The Federal Housing Administration's (k) loan program helps homebuyers and homeowners pay for home renovations. Homebuyers can use the (k) program to. Suppose you need a solution for Home Improvement, such as fixing burst pipes, water or electrical damage, roofing replacement, pool repair. SoFi's home improvement loans range from $5K-$K and they're unsecured, which means that your house is not used as collateral to secure the loan. Personal loans for home improvement A home improvement loan is a type of personal loan that helps you pay for renovations, repairs, and other improvements to. First, a home improvement loan is unsecured, meaning it does not require equity or collateral. A home equity line of credit, on the other hand, is secured by. A home improvement loan is a personal loan that you may borrow without securing it against your home. That means if you default at the loan, your home will not. Our online process makes it easy to apply for a home renovation loan. Fix a leaky roof, remodel your kitchen, or update your backyard—we're here to help. Personal Expense Loan. A good choice when you need money quickly for smaller projects and emergencies, such as a new roof, upgraded plumbing or adding a room to. An unsecured home improvement loan is essentially a personal loan that you take out for the purpose of making changes to your home. You borrow an amount of. Look at both secured and unsecured loans. Secured loans usually have lower interest rates but need your house as collateral. Unsecured loans don't need. It is generally wiser to get a personal loan instead of a renovation loan as it allows greater flexibility. This is an important consideration because one may. Must be used for a home improvement project · A good option if you don't have sufficient equity in your home · Available as a secured or unsecured loan · Fixed. A home improvement loan is a type of personal loan that homeowners can use to fund projects to enhance their properties. This could include tasks like. When you remortgage, you effectively take out a new mortgage and borrow more on top to pay for your home renovations. This could be a worthwhile move if you can. A personal loan can help you get the money you need up front to buy building materials, appliances or hire a contractor. That way you can get the money you need. Cover the cost of your home improvement project, big or small. · Home equity line of credit (HELOC) · Home equity loan · Cash-out refinance · Home improvement. A HELOC is a secured loan that requires collateral — the equity in your home. The process usually requires a home appraisal, which incurs a fee, and often. A home improvement loan is an unsecured personal loan taken out to finance home improvement or renovation. Home improvement loans through Prosper are a.

Mspy Work

What is mSpy? How Does mSpy Work; How to Install mSpy on Target Phone; The User-Interface; Top Features; mSpy Customer Service; Price; Pros and. mSpy Is Suited for Any Device. We've designed mSpy to work on all kinds of devices. Android and iPhone. Jailbroken, rooted, or fresh out of the box. Mspy company are complete scammers! The software doesnot work on idevices and according to them requires an installation with technician, which. Learn how the Bark Premium app stacks up against mSpy, a spyware app. work while potentially destroying trust. With Bark, you can: Monitor content. If you think your partner might be cheating, it's important to look into it. Spy apps, working on iPhones and Androids, can quickly uncover the. Stay involved in your child's online life by using mSpy to monitor Non-Jailbroken iOS Devices. You need the iCloud login details and backup. In case there is. No, the app works in the background mode and doesn't send any notifications to the target device. Just make sure to choose the option to hide the app's icon. If you need to keep an eye on your employees, mSpy is the app you need. You can also expect this app to be able to track the location of mobile devices on iOS. mSpy is a brand of mobile and computer parental control monitoring software for iOS, Android, Windows, and macOS. The app allows users to monitor and log. What is mSpy? How Does mSpy Work; How to Install mSpy on Target Phone; The User-Interface; Top Features; mSpy Customer Service; Price; Pros and. mSpy Is Suited for Any Device. We've designed mSpy to work on all kinds of devices. Android and iPhone. Jailbroken, rooted, or fresh out of the box. Mspy company are complete scammers! The software doesnot work on idevices and according to them requires an installation with technician, which. Learn how the Bark Premium app stacks up against mSpy, a spyware app. work while potentially destroying trust. With Bark, you can: Monitor content. If you think your partner might be cheating, it's important to look into it. Spy apps, working on iPhones and Androids, can quickly uncover the. Stay involved in your child's online life by using mSpy to monitor Non-Jailbroken iOS Devices. You need the iCloud login details and backup. In case there is. No, the app works in the background mode and doesn't send any notifications to the target device. Just make sure to choose the option to hide the app's icon. If you need to keep an eye on your employees, mSpy is the app you need. You can also expect this app to be able to track the location of mobile devices on iOS. mSpy is a brand of mobile and computer parental control monitoring software for iOS, Android, Windows, and macOS. The app allows users to monitor and log.

Is mSpy effective for parental control? Is mSpy a reliable spy app? Does mSpy's iOS product really work? How to tell if mSpy is installed on my phone? How. Yes, mspy is legal in Canada provided that certain conditions are met. For example, you must have a valid warrant from a judge or magistrate specifying the. AmSPy Android Monitoring User Activity Monitoring Software app is not available. QWhy is my mSpy not working? AYou need to make sure. Filter reviews by the users' company size, role or industry to find out how mSpy works for a business like yours. mSpy is more than an app. It's the key to the Internet. And it's yours to help you unlock their digital world, find out the truth, and rest a little easier. > Mspy. mSpy logo. mSpy. This profile is claimed by Altercon LP but has limited features. Do you work at Altercon LP? Upgrade your plan to access the full. Part 2: How to Stop Somebody Spying Using mSpy on Phone. Method 1: Spoof Location to Prevent mSpy from Location Tracking hot; Method 2: Use Anti-Spyware App. mSpy. This company's TrustScore is currently unavailable due to a breach How Trustpilot works · Press · Investor Relations · Download the Trustpilot iOS. spy app on your hands. Once again, the reason for it is easy to explain. Even when you're not using your phone, spyware may be running in the background. The app works in hidden mode, providing remote access for seamless and covert monitoring. mSpy icon 10+ years in the app market. Join now. Lasta picture. Based on my own experience, I would say that Elonmetro,com works well to spy on text messages on iPhones and Android phones. You not only know. Can mSpy be detected? No. mSpy is designed to work in hidden mode. That means 2 things: 1. There's no visible app on the home screen of the device. We can monitor work phone activity (calls, texts, apps) for all our employees from one central location. It simplifies monitoring and ensures everyone is using. mSpy works by installing a small hidden app to the device to be monitored. mSpy is a monitoring application that tracks all the activities of the target. Scam. Fraudulent! Made me upgrade from one package to another and yet the app didn't work. I was told I could get access to the phone without having. It's a parental control app that helps you monitor all your child's online activities. Table of contents. What is mSpy? How Does mSpy Work? What Are The Main. TheWiSpy is a hidden parental control app that provides parents with easy access to their kids' cellular devices. It works on a simple principle of recording. Does mSpy really work? Is it the right cell phone spy software for you? Click here to see my mSpy review to find out. Also includes coupon codes. Works on all devices It doesn't matter if they're chatting on iOS or Android. You can read their social media chats on all devices. Help is near If you run into. How to Detect mSpy on iPhone Devices. Part 2: How to Stop Somebody Spying Using mSpy on the phone? Method 1: Prevent mSpy from Spying via Phone Settings App.

Best Website For Tenant Background Check

I have used SmartMove by Transunion (website is mysmartmove dot com) for many years and it works well. You create a free account and send your potential tenant. A secure, user-friendly interface makes income verification a snap. Getting income information from prospective tenants is a good practice. Even better? SmartMove rental tenant screening, helps landlords identify the best tenants. Accurate credit, criminal, and eviction reports. FREE signup. Fast Results. LeaseRunner is the best tenant screening service. Screening details. Screening reports tailored to you. Mix and match any of our four online background check. FrontLobby is proud to offer the #1 Tenant Credit Check in Canada. All the Information You Need, None of the Gimmicks. This list will aid you in deciding which tenant screening service is best for you, your business needs and your wallet. We found that the best tenant screening service is First Advantage, which is one of the most comprehensive property management solutions with high-quality. E-Renter is an extensive online record database that can provide quick and accurate background checks on potential tenants in less than a few minutes. As a. FrontLobby is proud to offer the #1 Tenant Credit Check in Canada. All the Information You Need, None of the Gimmicks. I have used SmartMove by Transunion (website is mysmartmove dot com) for many years and it works well. You create a free account and send your potential tenant. A secure, user-friendly interface makes income verification a snap. Getting income information from prospective tenants is a good practice. Even better? SmartMove rental tenant screening, helps landlords identify the best tenants. Accurate credit, criminal, and eviction reports. FREE signup. Fast Results. LeaseRunner is the best tenant screening service. Screening details. Screening reports tailored to you. Mix and match any of our four online background check. FrontLobby is proud to offer the #1 Tenant Credit Check in Canada. All the Information You Need, None of the Gimmicks. This list will aid you in deciding which tenant screening service is best for you, your business needs and your wallet. We found that the best tenant screening service is First Advantage, which is one of the most comprehensive property management solutions with high-quality. E-Renter is an extensive online record database that can provide quick and accurate background checks on potential tenants in less than a few minutes. As a. FrontLobby is proud to offer the #1 Tenant Credit Check in Canada. All the Information You Need, None of the Gimmicks.

Access rental credit checks and tenant insights with Experian. We'll help streamline rental processes, make informed decisions and build trust. TVS is a premier nationwide tenant screening service that offers a fast and efficient screening service that will: provide a full credit profile; search. It takes less than 5 minutes to run a Tenant credit and background check. Best of all, you can choose who pays. View the Demo. Tenant Search. Best Tenant Screening Companies · 1) RentPrep · 2) E-Renter · 3) Leaserunner · 4) RentSpree · 5) Buildium · 6) SmartMove. MyRental. MyRental is a tenant screening and management platform for landlords, property managers, and real estate agents. · Avail · SmartMove · TurboTenant. Effortlessly screen potential tenants in minutes with lk-kojven.ru Get the information you need to find the best renter instantly. Top Tenant Screening Services of September · EzLandlordForms · RentSpree · LeaseRunner · My Rental · RentPrep · Smart Move · Buildium · TurboTenant. Comprehensive tenant screening guide for Chicago landlords. Learn best This website uses cookies to help us give you the best experience when you visit our. Find qualified residents with Buildium's comprehensive tenant screening software. Run tenant background checks and credit checks with ease. Try it free. Tenant screening you can trust. Instant background checks for landlords and property managers including credit, criminal, evictions and more. Get all the facts you need to choose the right tenant. Every Tenant Report includes a credit check, public record search, social media scans, and more. AAOA, the rental industry leader in tenant background checks nationwide. ✓ Protect your investment, run landlord credit reports for renters! Our Canadian-based property management software is the best in the game and can make your life much easier. Our software allows you to streamline tasks and. RentPrep is a community driven tenant screening services offering credit checks and rental background checks for tenant applicants. Online tenant screening for independent landlords · Great Reports · Great Convenience · Great Tenants · Built for independent landlords · SmartMove® benefits. RentPrep offers criminal background checks and credit screening for potential tenants in accordance with all local and federal legislation. All of RentPrep's. Powered by TransUnion, top-rated online screening with RentSpree is easy, fast, and free for agents and landlords. Start screening nowBook a demo. woman smiling. TransUnion's SmartMove is the best tenant screening service for people looking to get this service directly from a credit bureau. It offers a unique credit-. TenantCloud makes it easy to run a tenant background check, including criminal records, work history, past evictions, and more, thanks to tenant screening. Obtain background checks, credit checks and eviction history with Innago. Create custom, embeddable rental applications to find the best potential tenants.

When You Have To Pay Back Taxes

Apply for taxpayer relief If you can't pay your tax debt due to events beyond your control, like a serious illness, natural disaster or loss of employment. To receive a tax credit or benefit; To receive a tax refund; To make a payment. Learn more about how you can protect yourself from scammers and be scam smart. When you owe more than $25,, the IRS requires you to make payments through automatic withdrawals. · When you owe $25, or less in total taxes, penalties. You can also use the HMRC app to pay your bill through your bank's app or using online banking. You can pay the amount you owe in instalments before the. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? Payment Plan you submitted payment, unless your payment is scheduled for a future date. If you're unable to pay the entire tax bill within the first 60 days, you should pay what you can in order to avoid additional interest and penalties. Typically, the IRS has three years from your filing date to notify you if you owe back taxes, and 10 years from the date of the first notification to complete. If you do not pay the full amount of tax due when you file your return, we will send you a bill If we have notified you of unpaid past-due tax or returns that. Common reasons for owing taxes include insufficient withholding, extra income, self-employment tax, life changes, and tax code changes. To lower your tax bill. Apply for taxpayer relief If you can't pay your tax debt due to events beyond your control, like a serious illness, natural disaster or loss of employment. To receive a tax credit or benefit; To receive a tax refund; To make a payment. Learn more about how you can protect yourself from scammers and be scam smart. When you owe more than $25,, the IRS requires you to make payments through automatic withdrawals. · When you owe $25, or less in total taxes, penalties. You can also use the HMRC app to pay your bill through your bank's app or using online banking. You can pay the amount you owe in instalments before the. Have I Overpaid My Sales/Use/Employer Withholding Tax Account? Payment Plan you submitted payment, unless your payment is scheduled for a future date. If you're unable to pay the entire tax bill within the first 60 days, you should pay what you can in order to avoid additional interest and penalties. Typically, the IRS has three years from your filing date to notify you if you owe back taxes, and 10 years from the date of the first notification to complete. If you do not pay the full amount of tax due when you file your return, we will send you a bill If we have notified you of unpaid past-due tax or returns that. Common reasons for owing taxes include insufficient withholding, extra income, self-employment tax, life changes, and tax code changes. To lower your tax bill.

Taxpayers may pay their tax in a variety of ways: Use funds in the form of a personal check, money order or cashier's check. Said funds must come from a US . A Low Income Taxpayer Clinic (LITC) might be able to help you. LITCs help people of modest means who have a tax dispute with the IRS. Find out if you qualify. At times, paying off financial debts can be challenging. Unpaid property taxes may put your home at risk of being auctioned off at public auction, held annually. You do not need to enter them on the tax return. The calculation will tell you the total amount due for the year, and you subtract the payments on account from. The four alternatives are: An extension to pay: You can ask the IRS for up to days to pay your tax bill. You can use your credit or debit card to pay your taxes. We accept Visa We don't refund or reduce convenience fees for overpayment of taxes, nor does the. Cheques submitted for payment can not be retrieved or returned. Customers must contact their financial institution to place a stop payment on any cheque(s) they. If you file and pay electronically by April 15, you have until April 30 to make the electronic payment, using direct debit or a credit card. Electronic payment. On this page, find options available for paying your individual income tax, corporate income tax, and Georgia Department of Revenue assessed liabilities. Description, Details:If you have the funds to pay your due taxes now via digital check or direct bank transfer, you can do this online by going straight to the. If you couldn't pay your tax debt in the past due to events beyond your control―like a job loss, natural disaster, or serious illness―you may qualify for tax. The bottom line is if you have not filed taxes for several years or your tax debt is severely delinquent, you're on CRA's radar. The longer you avoid. If you can't pay in full, you may be able to set up a payment plan. If you To be eligible, you must have filed your taxes for the last 3 years. To. Technically, the IRS doesn't send anyone to jail for criminal tax code violations – it passes the case to the U.S. Department of Justice. There is a six-year. Delinquent Tax · You are charged a $20 fee · You must file and pay all tax returns on time and make the expected payments. · We continue to intercept any refunds. A Low Income Taxpayer Clinic (LITC) might be able to help you. LITCs help people of modest means who have a tax dispute with the IRS. Find out if you qualify. *Online payments are available for Department of Revenue issued notices, but not local tax bills. Collections. If you have a bill that is being handled. I pay my property taxes through my mortgage lender, how do I know the payment has been applied to my tax account? On this page, find options available for paying your individual income tax, corporate income tax, and Georgia Department of Revenue assessed liabilities. Taxpayers are required to meet certain obligations under Michigan law. You are responsible for filing a timely tax return. Payment of tax due must be received.

Home Finance Rates

Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. VA Loans are government-backed mortgages that offer highly competitive interest rates, with little to no down payment required. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. Compare Purchase Mortgage Rates ; Mortgage interest rates for KeyBank clients in Alaska · % · % ; Mortgage interest rates for KeyBank clients in Colorado. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. View More Rates ; District Lending. NMLS # · % · $1, /mo · % ; Nation Home Loans. NMLS # · % · $1, /mo · % ; New American Funding. The average rate on a year mortgage dipped to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since April. Today's competitive mortgage rates ; year · % · % ; year · % · % ; year · % · % ; 10y/6m · % · % ; 7y/6m · % · %. VA Loans are government-backed mortgages that offer highly competitive interest rates, with little to no down payment required. Today's year fixed mortgage rates ; Conventional fixed-rate loans · year. % ; Conforming adjustable-rate mortgage (ARM) loans · 10/6 mo. % ; Jumbo. Rates to refinance ; Year Fixed · % · % APR ; Year Fixed · % · % APR. Compare Purchase Mortgage Rates ; Mortgage interest rates for KeyBank clients in Alaska · % · % ; Mortgage interest rates for KeyBank clients in Colorado. New home purchase ; year fixed mortgage · % · % ; % first-time-homebuyer · % · %. Compare mortgage rates when you buy a home or refinance your loan. Save money by comparing free, customized mortgage rates from NerdWallet. View More Rates ; District Lending. NMLS # · % · $1, /mo · % ; Nation Home Loans. NMLS # · % · $1, /mo · % ; New American Funding. The average rate on a year mortgage dipped to % this week, according to Bankrate's lender survey. Thirty-year rates haven't been this low since April.

Today. The average APR on a year fixed mortgage is %. Last week. %. year fixed-rate jumbo mortgage.

An escrow (impound) account is required. The rate lock period is 60 days and the assumed credit score is At a % interest rate, the APR for this loan. If you want to make lower monthly payments and plan to stay in your home for a long time, a year fixed could be the ideal option for you. The year fixed. Rates shown reflect current products available with Rocket Mortgage, a provider on our network. year Fixed-Rate Loan: An interest rate of % (% APR) is. Other restrictions and limitations apply. Home lending products provided by JPMorgan Chase Bank, N.A. Member FDIC. Follow us. National year fixed mortgage rates go up to %. The current average year fixed mortgage rate climbed 2 basis points from % to % on Monday. What are today's mortgage rates? The average year fixed mortgage rate fell to % from % a week ago. Compared to a month ago, the average year. Mortgage rates as of September 4, ; % · % · % · % ; $1, · $1, · $1, · $1, Today's Rate on a Year Fixed Mortgage Is % and APR % In a year fixed mortgage, your interest rate stays the same over the year period. Mortgage Interest Rates ; Traditional First-Time Homebuyer Program · First-Time Homebuyer Program · % ; Next Home · Non-First-Time Homebuyer Program · %. We are cash-out experts. We offer low rates on Cash Out Refinances, Second Mortgages & Home Equity Loans. Estimate your monthly payments, annual percentage rate (APR), and mortgage interest rate to see if refinancing could be the right move. Check today's mortgage rates for buying or refinancing a home. Connect with us to estimate your personalized rate. Keep up to date on the latest housing industry trends with insights, analysis and news delivered to your inbox. Subscribe. What's on Your Mind? Send your. With a fixed-rate mortgage, your interest rate stays the same from the time you get the loan until you pay it off. That's true whether you end up keeping the. Today's competitive mortgage rates ; year fixed · % · % · ; year fixed · % · % · ; 5y/6m ARM · % · % · A fixed-rate loan of $, for 30 years at % interest and % APR will result in a monthly payment of $1, Taxes and insurance not included;. Home buyers, get reduced rates your first 2 years. We're giving home buyers an exclusive break on two of our 3% down loan options: HomeReady® and Home Possible®. Over 30 years, an interest rate of % costs $, more than an interest rate of %. Customized mortgage rates ; 7/6 ARM, % (%), $2, ; year fixed, % (%), $ ; year fixed, % (%), $ ; year fixed, % . With a fixed-rate mortgage, your interest rate stays the same from the time you get the loan until you pay it off. That's true whether you end up keeping the.

Suing A Doctor For Medical Negligence

While the basic requirements for a medical malpractice claim vary from state to state, there are four basic elements you need to prove to show that malpractice. We help with medical negligence in New York. Every medical malpractice case we handle is staffed by highly skilled and experienced lawyers. Medical malpractice lawsuits are usually complicated. Talk to a lawyer before you start a case. Meet deadlines You have to file your lawsuit before a dead. What Counts As Medical Malpractice? · A caregiver must owe you a standard of care, meaning a level to which they can reasonably be expected to treat you. · The. If you have a potential medical malpractice case in New York, call our attorneys today at or contact us online for a no-obligation case review. Medical malpractice is a type of personal injury claim that involves negligence by a healthcare provider. Most medical malpractice cases come down to being able to prove how the doctor's mistake caused an injury. Additional Requirement: Certificate Of Merit. Georgia. To pursue a medical malpractice lawsuit, however, you must show that your doctor's actions caused you an injury. Simply being dissatisfied with a healthcare. However, medical malpractice suits are expensive, hard to win, and present many challenges. So, if you believe you have a medical malpractice law claim, you. While the basic requirements for a medical malpractice claim vary from state to state, there are four basic elements you need to prove to show that malpractice. We help with medical negligence in New York. Every medical malpractice case we handle is staffed by highly skilled and experienced lawyers. Medical malpractice lawsuits are usually complicated. Talk to a lawyer before you start a case. Meet deadlines You have to file your lawsuit before a dead. What Counts As Medical Malpractice? · A caregiver must owe you a standard of care, meaning a level to which they can reasonably be expected to treat you. · The. If you have a potential medical malpractice case in New York, call our attorneys today at or contact us online for a no-obligation case review. Medical malpractice is a type of personal injury claim that involves negligence by a healthcare provider. Most medical malpractice cases come down to being able to prove how the doctor's mistake caused an injury. Additional Requirement: Certificate Of Merit. Georgia. To pursue a medical malpractice lawsuit, however, you must show that your doctor's actions caused you an injury. Simply being dissatisfied with a healthcare. However, medical malpractice suits are expensive, hard to win, and present many challenges. So, if you believe you have a medical malpractice law claim, you.

If this negligence leads to an actionable wrong against someone else, it is considered medical malpractice and can be grounds for legal action. It is important. As a patient, you have two years and six months to file a medical malpractice lawsuit in most cases. The statute of limitations runs from the last day you. We represent victims of all types of medical malpractice in New York, as well as the families of those who tragically passed away due to preventable medical. Our highly-skilled, highly experienced team of Kansas City medical malpractice lawyers are here to help. We have a great track record in dealing with medical. If you're suing about the care or treatment you received, you almost always need an expert witness You will need to prove in court that what the healthcare. The Sanders Law Firm boasts a long track record of settlements and verdicts in medical malpractice cases. We have recovered hundreds of millions of dollars for. These questions and answers will provide you with an overview of what you need to know about Massachusetts medical malpractice laws. Suing for Medical Malpractice in California. Under state law, a patient may pursue a civil claim called medical liability or medical malpractice against. The short answer is no, you cannot sue a doctor for pain and suffering. You can sue for medical malpractice, however, and be awarded damages for pain and. Victims of medical malpractice in North Carolina have up to three years from the date of the medical treatment that caused the injury, or one year from which. Generally speaking, you can sue for emotional distress or pain and suffering when you're harmed because of the negligence of a doctor or other medical. Doctors are required to advise you of the risks so you can give informed consent to having the procedure done. When the doctor does not do so, and the risk. Doctors can be sued if they breach the duty of care owed to a patient and it results in serious or fatal harm. In general, a medical malpractice lawsuit in Texas has a two-year window, so in most cases, you would have two years to sue a doctor after surgery. Remember, you only have one opportunity to sue your doctor for negligence. There are no do-overs in the civil justice system. If you were seriously injured or. Abdella & Sise LLP in Gloversville, New York, offers legal services for medical malpractices. Call for a free consultation today: () When a doctor or other medical professional breaks this oath, they are considered negligent in legal terms. When a court is attempting to determine if a medical. Medical malpractice cases are extremely difficult to endure because they are emotionally and physically hard on the victim as much as they are demanding. Victim of malpractice? Our White Plains medical malpractice lawyers will fight for the benefits you deserve. Free consultations ()